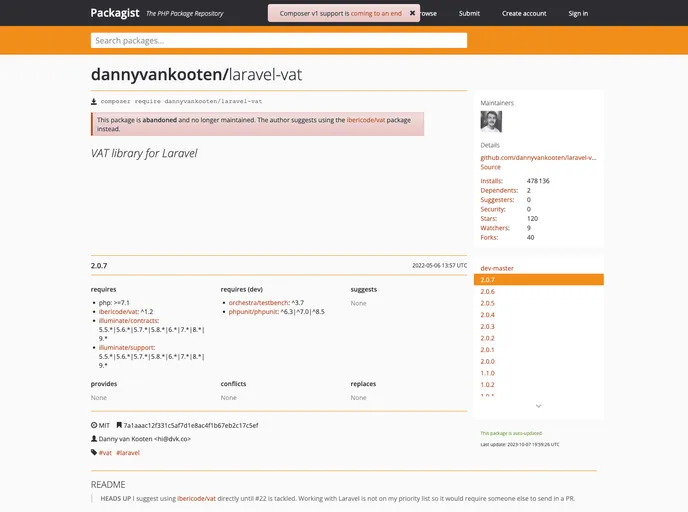

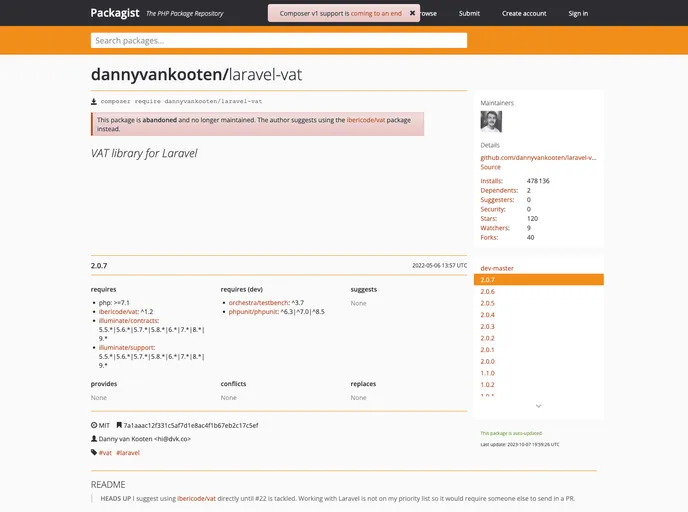

Laravel Vat

EU VAT library for Laravel

Overview

The Laravel VAT package is a powerful tool designed to help businesses in the EU manage VAT legislation with ease. By integrating with the core ibericode/vat library, it simplifies the process of fetching VAT rates, validating VAT numbers, and ensuring compliance with ISO country codes. This package is an essential resource for developers who want to streamline VAT-related processes in their Laravel applications.

With the ability to geolocate IP addresses and perform historical VAT rate lookups, this package is invaluable for businesses that operate across multiple EU member states. The automatic registration via Composer and built-in caching mechanism also enhance its usability, making it a great choice for developers looking to implement VAT solutions quickly and efficiently.

Features

- Easy VAT Rate Fetching: Retrieve historical VAT rates for all EU member states effortlessly using the ibericode/vat-rates functionality.

- VAT Number Validation: Validate VAT numbers by checking their format, existence, or both, ensuring accurate data handling.

- ISO Code Validation: Ensure compliance by validating ISO-3316 alpha-2 country codes, helping maintain high data integrity.

- EU Membership Checker: Determine whether a country is part of the EU, streamlining compliance verification processes.

- Geolocation Support: Leverage IP address geolocation to enhance user experience and VAT applicability.

- Automatic Installation: The package automatically registers itself upon installation via Composer, simplifying the setup process.

- Caching Mechanism: VAT rates are cached for 24 hours by default, improving performance and reducing unnecessary API calls.

- Localization Support: Easily customize validation error messages by utilizing translation strings, allowing for a more localized user experience.